RMIT Vietnam receives global award for PR education

RMIT Vietnam has been named the Global Public Relations Academic or Educational Institution of the Year 2025 by the Global Alliance for Public Relations and Communication Management.

Vietnamese students soar at global creative awards

RMIT University Vietnam students started 2026 strong with top honours at major creative competitions in Singapore and the UK, once again spotlighting the strength of Vietnamese creativity on the world stage.

Affiliate marketing boom sparks intellectual property and trust concerns

The explosive growth of affiliate marketing across social media and e-commerce platforms is exposing significant legal and ethical risks, according to experts from RMIT Vietnam.

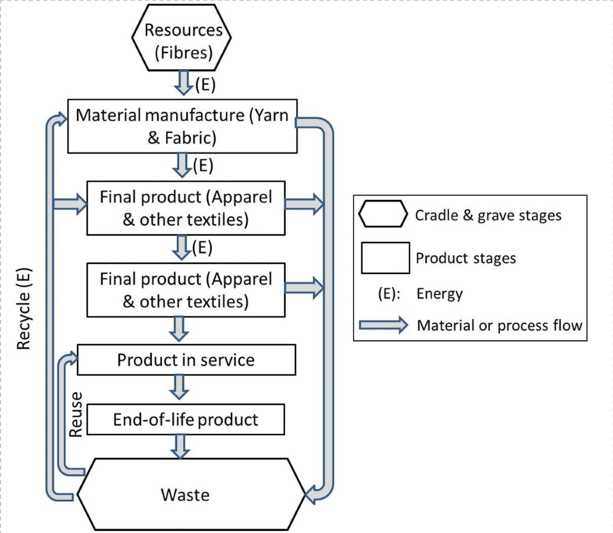

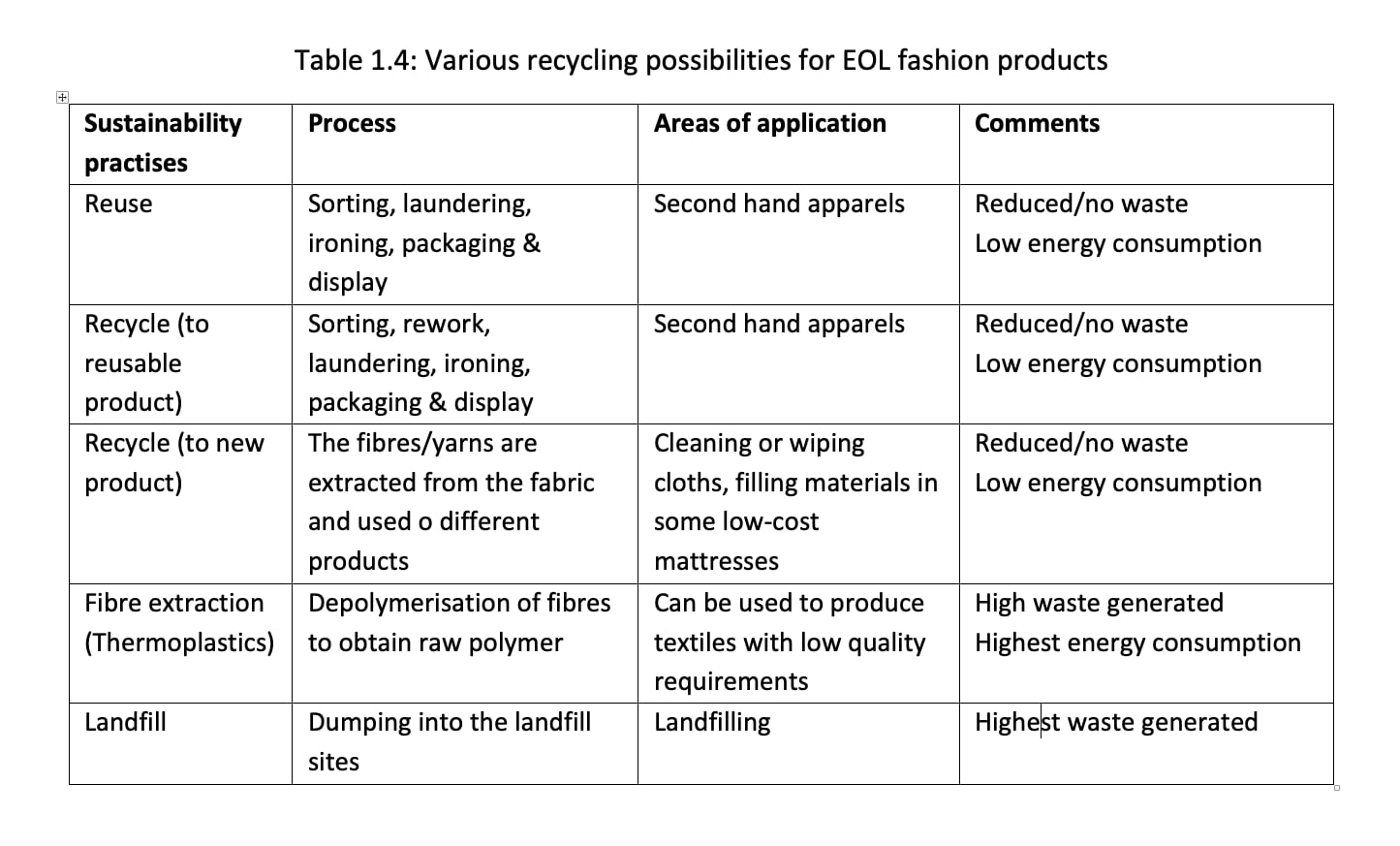

High-emission sectors face reckoning as EU carbon tax takes effect

Hidden costs in the supply chain could price some Vietnamese exporters out of Europe.