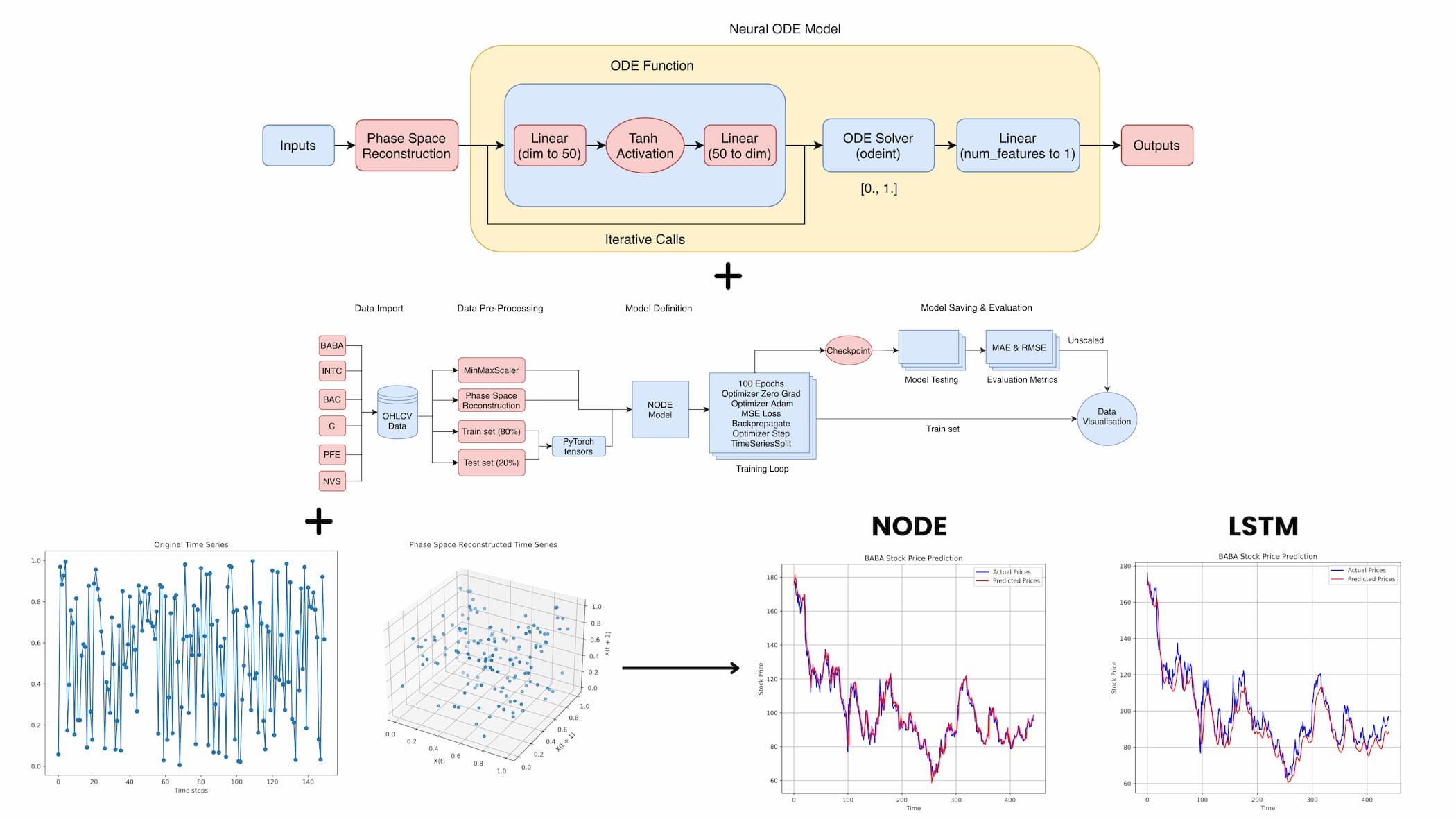

“Finally, NODE demonstrates superior forecasting accuracy compared to its closest competitor, LSTM, in predicting long-term values with minimal deviations over 1000-time steps, reducing errors by more than 70 per cent for each stock,” said Quoc Anh.

Dr Ha Xuan Son said the model addresses the limitations of traditional deep learning methods in capturing complex, non-linear stock market dynamics.

“It demonstrates superior long-term forecasting accuracy and effectively captures sudden market shifts like flash crashes.

“Beyond stock forecasting, the model shows promise in predicting other chaotic systems, as evidenced by tests on Lorenz and Mackey-Glass datasets,” said Dr Son.

Quoc Anh encountered various challenges during his research, with technology proficiency being the most demanding.

"I had to self-learn languages like Python, SQL, LaTeX, utilise tools such as GitHub, MongoDB, Lightning AI, retrieve data from APIs, and master the skill of searching for and comprehending research, primarily through technology forums or YouTube tutorials,” said Quoc Anh.

Dr Son said Quoc Anh possesses a natural aptitude for academic inquiry, showing keen analytical skills and a talent for innovative problem-solving.

“His ability to grasp complex concepts quickly and apply them creatively sets him apart as a promising young scholar,” said Dr Son.

In addition to “Phase space reconstructed neural ordinary differential equations model for stock price forecasting”, Quoc Anh is the lead author of a paper titled “Transforming stock price forecasting: Deep learning architectures and strategic feature engineering”. This paper will be published in Springer’s Lecture Note of Artificial Intelligence (LNAI) and presented at the 21st International Conference on Modelling Decisions for Artificial Intelligence (MDAI) 2024, hosted at Meiji University, Japan.