The growth of Vietnam's economy and financial markets has made the finance sector a compelling choice with many career opportunities and competitive salaries. However, many parents and students don't fully understand the finance industry or know about its job prospects upon graduation.

This article may help to answer questions about finance and provide detailed information around the topic.

Finance is a broad field of study related to activities involving money flow. This includes subjects such as investments, loaning credit, banking and capital allocation. It also includes the study of relationships between various entities in the economy, such as governments, banks, businesses, and investors. Upon graduating with a degree in finance, you can work in roles across a number of organisations.

To advance in your career in finance, you need two factors, qualifications and skills.

For sustainable and long-term success, obtaining a degree such as a bachelor's, master's, and doctorate is essential.

Earning professional certifications also plays a crucial role in supporting your career as it can improve your professional capabilities.

Professionals in the finance sector need strong data and calculation skills, with a robust knowledge of Excel and its functions, including the use of Visual Basic (VBA) and pivot tables.

Finance professionals also need to cultivate soft skills, including

There is a common misconception that a degree in Finance or Banking limits graduates to roles within banks or financial offices. This field actually presents diverse career opportunities.

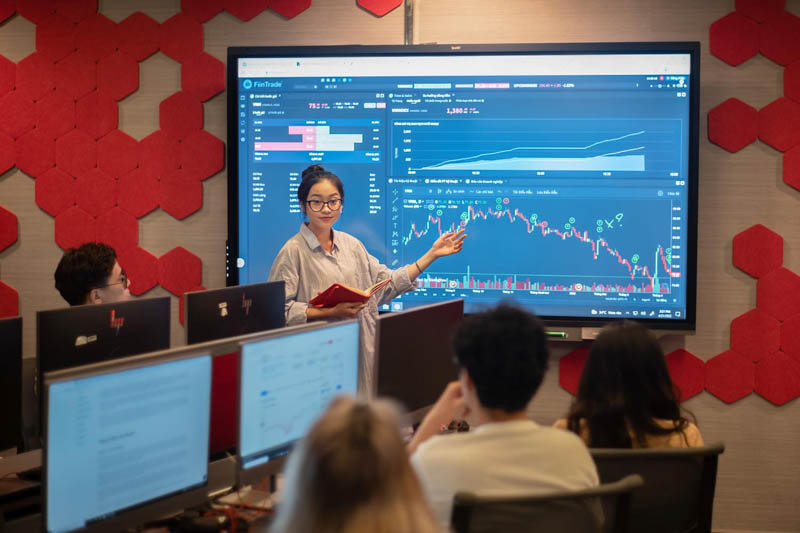

A stockbroker works closely with investors, understanding client requirements and timing the trading sessions. Professionals within this role has the ability to grasp changes and fluctuations in each trading session to make prudent investment decisions, thereby minimising risks for investors.

This is a dynamic and high-pressure work environment, requiring a high degree of meticulousness and caution. The expectation of achieving the highest returns for clients contributes to the significant pressure in this job.

Financial analysts are highly skilled professionals in the finance sector. They receive professional training to possess

Financial analysts must possess extensive knowledge of both theoretical and practical aspects of financial investment, such as portfolio management, asset valuation and various types of securities. They also need to be proficient in quantitative analysis and have a deep understanding of legal regulations related to international finance and state-regulated commodities. Experience with Enterprise Resource Planning (ERP) systems is essential for this position.

A financial investment specialist is responsible for undertaking researches and analysis of the financial market, selection of appropriate investment assets and financial transactions execution to maximise profits.

This role requires in-depth knowledge of economics and the financial market, as well as strong analytical and evaluatory skills. It is considered a position with an attractive income but requires excellent risk management skills to navigate the volatility and uncertainties of the financial market.

A bank teller's role involves conducting basic banking transactions such as accepting deposits, processing withdrawals, transferring funds and paying bills.

As the direct provider of services to customers, bank tellers play a crucial role in building a reputable company image with customers.

A financial manager is responsible for accountabilities related to the financial planning process, such as developing plans for capital mobilisation and utilisation, preparing reports on the feasibility and progress of financial targets, monitoring the company's financial data system, and preparing financial statements.

Accounting is a well-known profession that holds a vital position in businesses with responsibilities including:

Accountants are considered the linguists of business - they assist investors, regulatory agencies and creditors with the recorded cash flow and make informed investment decisions.

Auditing is typically conducted by an independent auditing firm or internal auditing staff. They are responsible for examining and evaluating the financial information of an organisation or individual in a highly accurate manner. Specific tasks include:

Currently, there are three main types of auditing jobs: State Auditing, Internal Auditing, and Independent Auditing.

Debt collectors assist businesses in managing and pursuing overdue debts from customers, including both personal and corporate debts. Debt collection officers perform tasks such as:

This role requires strong communication, persuasion, persistence, and problem-solving skills.

This is a particularly important role within a sponsoring company, as you are responsible for screening and reviewing projects before they are presented to the investor management team or sponsoring agency for a final decision. This position comes with attractive remuneration and salary, along with benefits from sectors such as banking and brokerage firms.

A procurement officer is responsible for sourcing, selecting, and purchasing products or services that meet the company's needs. Here are the main tasks associated with this role:

A budget analyst is a crucial position playing a decisive role in a company's development. Individuals in this role analyse the budget reports of an organisation or business. They need the ability to analyse and plan finances for the future. The responsibilities of a budget analyst include:

A personal financial advisor provides financial advisory services to individuals and households, assisting clients in budget planning and allocation. The main tasks of this role include:

A risk manager's role involves analysing and assessing potential risks and proposing preventative measures. This position requires knowledge of risk management practices, such as insurance, futures contracts, and capital management.

This is a sought-after position in the finance industry, as it requires experienced individuals to identify risks and vulnerabilities before approving applications. A valuation specialist is responsible for appraising products, including real estate and intangible assets, at specific times and locations. Specifically, they:

In this role, individuals with more experience and higher educational qualifications can command attractive salaries, especially when holding key positions in large organisations.

Students pursuing a degree in Finance often choose from the following common working environments to develop their careers:

This comprises of investment and commercial banks.

You can work at investment banks in roles such as investment advisor or stockbroker. Investment banks and securities companies provide an ideal working environment for Finance graduates. Within this position, you will have the opportunity to work in a professional setting where advisors assist companies and corporations with buying and selling shares and managing investment portfolios. Notable examples include SSI Securities Corporation (SSI – HOSE), Vietcombank Securities, Techcom Securities, and MB Securities (MBS).

Commercial banks are suitable workplaces for credit specialists, loan officers, and banking transaction experts. Here, they perform specialised tasks related to coordinating and managing cash flows, such as loan and savings.

If you are looking for a stable job with a competitive salary, commercial banks are a reasonable choice. You can apply to banks such as Vietcombank, BIDV, Agribank, Vietinbank, and Techcombank.

Investment funds are organisations that specialise in managing and providing capital for investors. They often seek personnel with strong analytical and forecasting skills to develop asset management strategies and generate profitable investments for individuals and organisations.

Some renowned investment funds include the Asean Small Cap Fund, Vietnam Investment Fund, Dragon Capital Vietnam Enterprise Investment Ltd, VinaCapital, Mekong Capital, VOF, and CII.

Securities companies offer a dynamic and challenging work environment, suitable for those who enjoy volatility and growth. Common roles in securities companies include buying and selling securities, brokerage, underwriting securities for clients, and providing investment fund management and advisory services for commissions.

Insurance companies provide products such as health, life, accident, and children's education insurance. In this setting, you'll work with clients to sign contracts and manage insurance premiums.

Finance staff are responsible for managing financial issues within a business, such as mergers, acquisitions, profitable investments, or capital adjustments to enhance value and increase profits.

The finance and banking sector consistently ranks among the top fields with high demand for personnel. This is due to the sector's diversity, encompassing areas such as banking, corporate finance, insurance, and taxation.

According to experts, from 2020 to 2025, the demand for high-level personnel in the Finance sector is expected to increase by 20%. Specifically, the finance and banking sector will account for about 5%, equating to 15,000 employees per year. Recruitment activities are particularly concentrated in major cities such as Ho Chi Minh City, Hanoi, and Da Nang.

Salary is an important factor for many, especially in the Finance sector, where income is generally stable and attractive. You can refer to the average salary levels based on the experience of personnel in the industry:

By studying Finance at RMIT, you will experience an internationally standardised education, tailored to the economic and market context of Vietnam. Graduates will receive a degree from RMIT University Melbourne, which meets the highest standards of the Australian education system and is recognised by employers worldwide.

Finance is a major within RMIT's Bachelor of Business program. Students can choose to study Finance along with up to one other major and two minors:

Studying Finance at RMIT allows students to deeply explore the connections between diverse business activities within organisations and enterprises in various segments. The program combines financial theory with practical problem-solving for real-world business issues, helping students build a solid foundation of knowledge.

In addition to providing practical knowledge, RMIT also facilitates student participation in numerous extracurricular activities, helping them develop soft skills and teamwork abilities. Moreover, RMIT's extensive network of businesses offers students access to internships and job opportunities while being undergraduates. All mentioned factors will equip students with the confidence and readiness for the global job market in the future.

Program details and tuition fees are subject to change. Please refer to the Bachelor of Business program page for the most up-to-date information.