Building trust: A strategic shift for Vietnamese businesses

According to Dr Erhan Atay, Senior Lecturer in Human Resource Management at RMIT Vietnam, outdated management styles are slowing Vietnamese companies down. To stay competitive, they must shift from control to trust.

How to deal with the surge in counterfeit essential goods?

Logistics and supply chain management experts share practical advice for businesses and consumers to combat the rise in counterfeit goods – an issue that continues to stir public concern.

Tourism and hospitality boom puts spotlight on skills shortage

As Vietnam’s tourism and hospitality industry rebounds and diversifies, RMIT experts warn that a growing skills gap may stall progress if workforce development does not keep pace with rising demand.

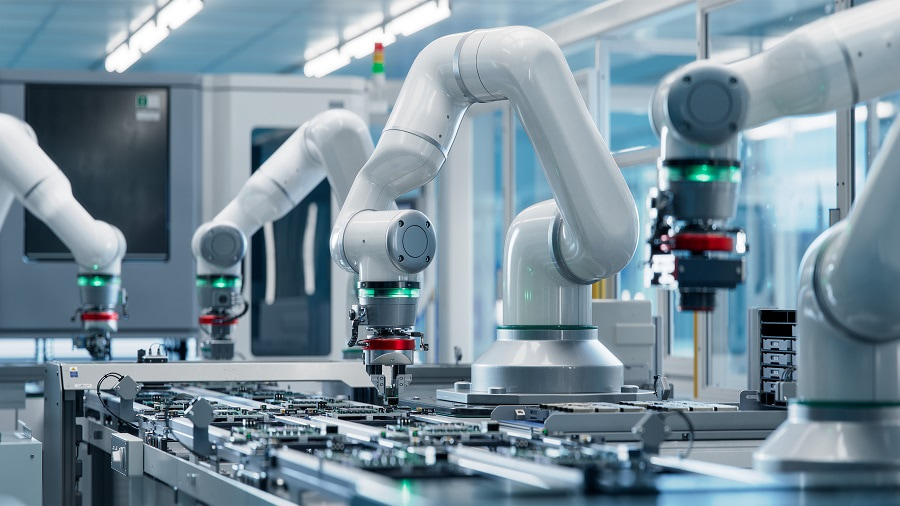

Vietnam’s new trade deal with the US opens path to business restructuring

Vietnam’s preliminary trade deal with the US helps the country avoid a steep 46 per cent tariff, but ushers in a new era of higher costs, forcing businesses to restructure and adapt.