What were your thoughts on the potential opportunities for Vietnam's supply chain when the country was invited to join the unofficial Quadrilateral Security Dialogue (Quad) video conference on combating COVID-19 and reviving the economy post-pandemic?

Being part of the Quad+ dialogue was obviously a great opportunity for Vietnam’s economy, but the road ahead is not going to be easy nor fast. Vietnam is already a world champion in trade; it amounts to around 200% of its total GDP. To put that into context, trade represents 38% of China’s GDP and the world average is around 60%. Only a handful of rather small countries exceed Vietnam in trade intensity.

With trade levels already very high, Vietnam is facing a big challenge - increasing the value as part of the global supply chain, rather than increasing merely the trade volume. A relatively low GDP per capita but high trade intensity in the past has meant that there hasn’t been ‘much left on the table’ for Vietnam in the global supply chain.

Vietnam is now in a positive position to reimagine its role as a value-creating partner in the global supply chain, and consider things like training the semi-skilled labour force, supporting the formation production clusters, investing in infrastructure, and enforcing more stringent governance standards.

This event may also accelerate important economic reforms that can enable Vietnam to not only create more value in the global supply chain, but also to become more competitive in the global economy.

What would Quad need to see from Vietnam in order to select the country to join the group?

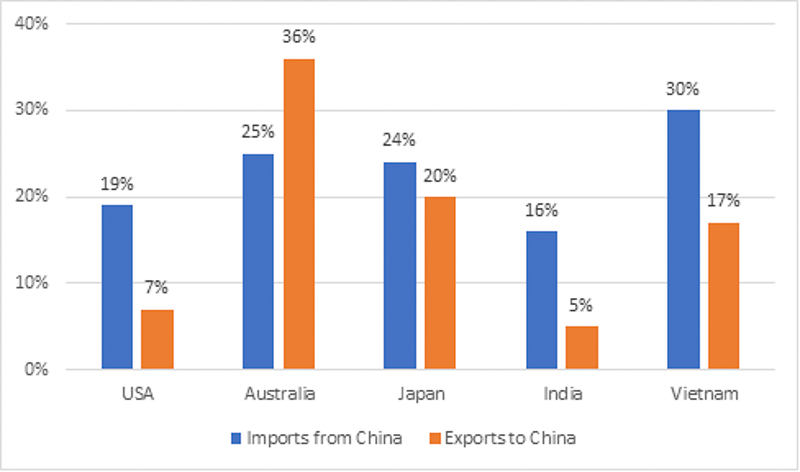

China is the dominant source of imports for all participants in the Quad group, accounting for 16-25% of all imports (it’s also worth noting that 30% of Vietnam imports originate from China). This creates an economic dependency for the US and the other group members, which in turn reduces their political and diplomatic clout.

Vietnam is a natural candidate to lessen this dependency on China. It is a populous country with an abundance of semi-skilled labour, established trade relationships and agreements, and an agile and flexible economy able to respond swiftly to the ever-increasing speed of product innovation.

The key features required by foreign investment are not dissimilar to China, which means a relocation to Vietnam can happen quickly. Perhaps even more important than the economic drivers for Vietnam is the alignment of all member states on trade policy objectives.

Addressing the trade imbalance with China has been on the agenda for a long time. The COVID-19 pandemic has highlighted the issues arising from concentrated supply chains and has infused urgency to act fast and build more resilience.