What Vietnam should do in the coming years

Vietnam’s government has recently signed a decision approving a plan on the implementation of RCEP which aims to assign tasks and responsibilities to relevant agencies and organisations, decide on measures related to direction and administration, and other elements to implement this agreement fully and effectively.

Several improvements need to be carried out in Vietnam in the coming years:

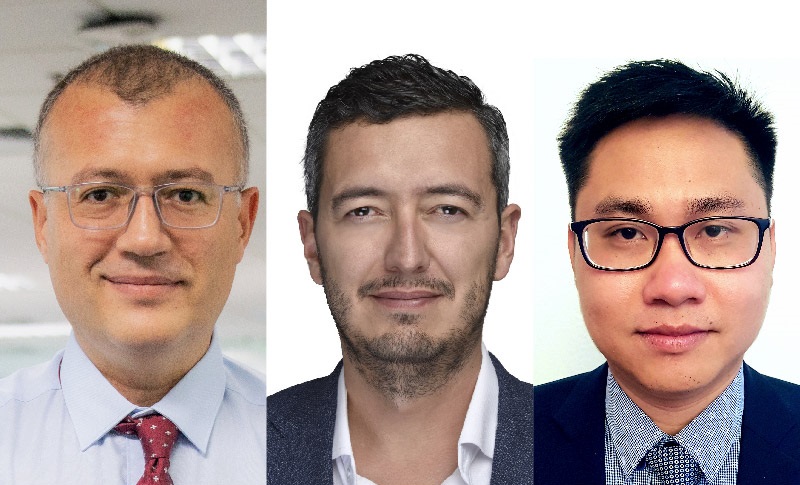

RMIT International Business lecturer Dr Santiago Velasquez said Vietnam should focus on higher-value products while maintaining close control of raw materials.

“As a key player in the global supply chain, Vietnam will continue to become more attractive for FTAs – both bilateral and multilateral – as other countries will tend to secure the flow of raw materials and consumer products,” Dr Velasquez said.

“Vietnam will continue to see opportunities from commodities and primary production industries. However, the most lucrative endeavors will emerge from higher-value manufacturing,” Dr Velasquez explained.

By improving both in terms of technology-adoption and labor-skillsets, Vietnam would export higher-value products while still maintaining close control of the raw material supplies. As a result, these higher-value products would be highly competitive with respect to production, transportation, and FTA-alleviated import costs, he added.

The Vietnamese government would also need to continue restructuring the economy and focus on institutional reforms. A strengthened banking sector and better business environment would facilitate trade and enable firms to use the opportunities brought about by the FTAs.

While institutional reforms may take decades, and a short-term recommendation is expected for the year to come, the emphasis should be on how we manage to implement the agreement efficiently.

Dr Duy said improved information disseminationto firms, especially SMEs, should be the government's priority.

“Firms need to be well informed of RCEP from a business perspective: new market opportunities, challenges they may face, the support they may expect from the government, and what they need to do to gain benefits from these FTAs,” he said.

“In addition to information dissemination, the government needs to focusmore attention to capacity-building activities to help improve the competitiveness of domestic firms,” he said. “Capacity-building activities should help firms realise their position in regional and global value chains and help them understand how to maintain that strategic position and gradually move up the value chain.”

Story: Thuy Le